CNBC

- Sen. Elizabeth Warren criticized Warren Buffett's tax practices in an open letter.

- The senator wants an investigation into how banks and wealth managers enable tax avoidance.

- ProPublica recently reported how Buffett and other billionaires minimize their tax bills.

- See more stories on Insider's business page.

Billionaires aren't paying their fair share of taxes, and the banks and wealth managers enabling them should be investigated, Sen. Elizabeth Warren and Sen. Sheldon Whitehouse said in an open letter on Wednesday.

Warren and Whitehouse wrote to Ron Wyden, the chairman of the Senate's finance committee, after ProPublica obtained the tax records of many ultra-wealthy Americans and published some of its findings.

The lawmakers highlighted the non-profit journalism outlet's "deeply troubling allegations" that billionaires have borrowed huge sums against their companies' stock to fund their lavish lifestyles, then deducted the interest on those loans from their taxable income, meaning they've paid zero federal income tax in some years. Borrowing also spares them from having to sell stock and incur capital-gains taxes.

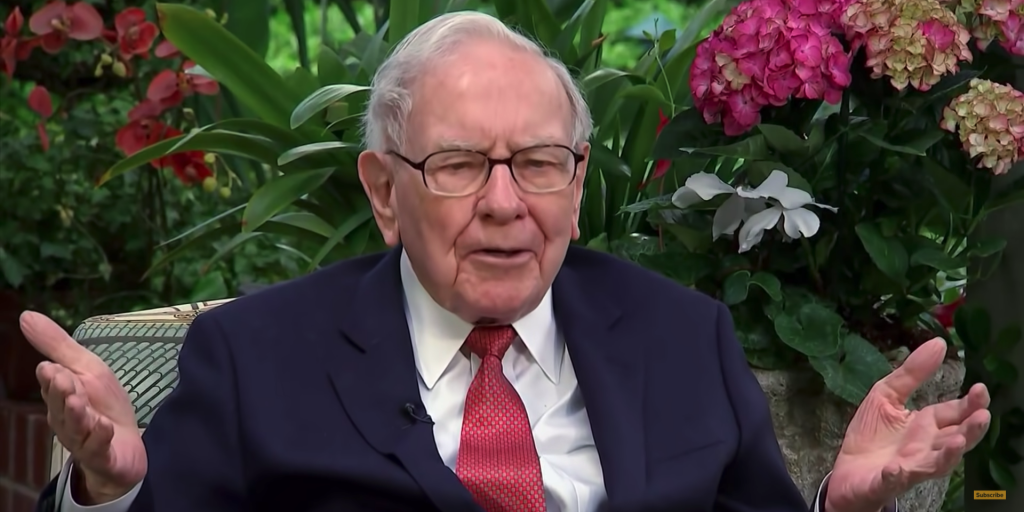

The senators called out Warren Buffett, the famed investor and Berkshire Hathaway CEO, for paying taxes equivalent to less than 0.1% of the $24 billion increase in his wealth in 2018. They also noted that Amazon founder Jeff Bezos claimed a $4,000 child tax credit and reported a loss on his tax return in 2011, when he was worth $18 billion.

"This tax avoidance by the nation's wealthiest individuals is profoundly unfair," Warren and Whitehouse wrote. The pair argued that billionaires shortchanging the government prevents it from investing in education, healthcare, infrastructure, and the environment. It also exacerbates inequality, distorts the US economy, and results in an unfair tax burden for low-income and middle-class families, they added.

While the vast majority of the ultra-wealthy's tax practices are legal, they allow those individuals to "reap billions from their investments and live lives of privilege that are beyond the imagination of most families," the lawmakers said.

Warren and Whitehouse called on Wyden and his committee to investigate the matter, hold hearings, and craft new laws to prevent tax avoidance. In particular, the pair urged them to investigate the large financial institutions that provide large, cheap, stock-backed loans to the super rich, letting them live on borrowed money instead of taxable income.

While the senators singled out Buffett, there's no indication the investor borrows money to fund his relatively modest lifestyle, or has ever paid zero federal income tax. ProPublica said the billionaire minimizes his tax bill by not paying a dividend and keeping his wealth in Berkshire stock. Yet his shareholders have overwhelmingly voted against a dividend, and long-term stock ownership is a key element of Buffett's investing philosophy.

Moreover, Buffett has called for higher taxes on the wealthy, and recently reached the halfway point in his goal of gifting 99% of his fortune to good causes.